geothermal tax credit 2021 irs

102-486 made the credits for solar and geothermal permanent. Understanding the Federal Tax Incentives for Geothermal Heat Pumps The 26 federal tax credit was extended through 2022 and will drop to 22 in 2023 before expiring altogether so act now for the most savings.

10 Tax Breaks You May Be Overlooking

Please visit the Database of State Incentives for Renewables Efficiency website DSIRE for the latest state and federal incentives and rebates.

. IRS Form 5695 Explained Claim Solar Tax Credit One of the reasons you may have gone solar for your home is the Federal Investment Tax Credit ITC commonly known as the Solar Tax Credit. The credits will expire on January 1 2024. Residential credits will remain at 26 of the total installation cost through 2022 stepping down to 22 in 2023.

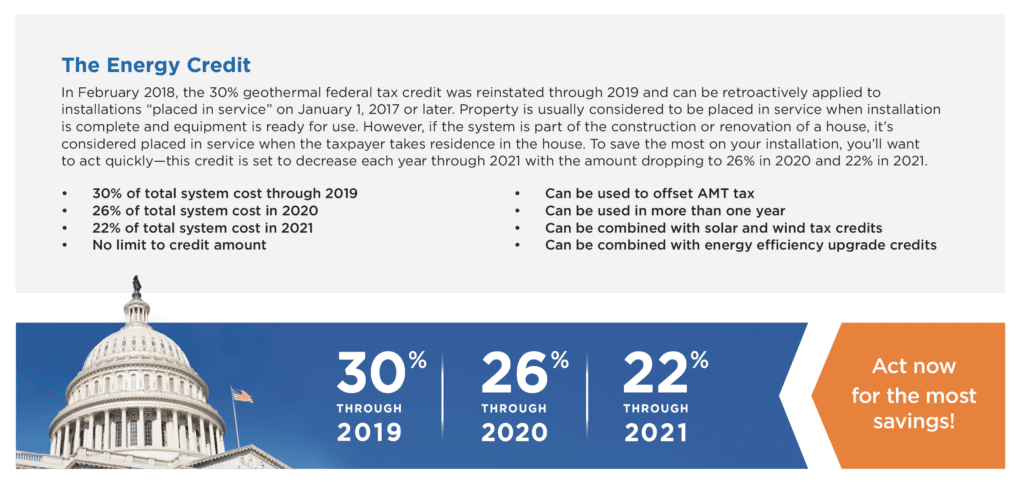

Its gone through cycles of expiration and extension over the last 15 years most recently expiring at the end of 2016 and undergoing reinstatement in 2018. In 2018 2019 2020 and 2021 an individual may claim a credit for 1 10 of the cost of qualified energy efficiency improvements and 2 the amount of the residential energy property expenditures paid or incurred by the taxpayer during the taxable year subject to the overall credit limit of 500. The credit is worth 30 for upgrades made before December 31 st 2019.

The geothermal heat pump is replacing a prior geothermal heat pump installed in 1995. The incentive will be lowered to 22 for systems that are installed in 2023 so act quickly to save the most on your installation. SBAgovs Business Licenses and Permits Search Tool allows you to get a listing of federal state and local permits licenses and registrations youll need to run a business.

The 2021 geothermal tax credit has been around in various forms since 2005. The amount will drop to 22 in 2021. As of 2021 biomass fuel stoves are included in tax credits for residential renewable energy products.

The Federal ITC makes solar energy more affordable for. This created a 26 tax credit for costs associated with qualified geothermal equipment placed in service through the end of 2021 for all Dayton Springfield and SW Ohio residents. The Energy Credit In December 2020 the tax credit for geothermal heat pump installations was extended through 2023.

The Energy Policy Act of 1992 PL. The Nonbusiness Energy Property Credit. The Consolidated Appropriations Act 2021 signed into law on December 27 2020 extends the federal tax credit for geothermal heat pump installations through 2023.

Tax Credits Rebates Savings Page. 12000 x 26 3120 Qualified geothermal heat pump property expenditures include replacement units as long as they meet the eligibility requirements. Credits Good Thru 2021 In October 2008 geothermal heat pumps were added to section 25D of the Internal Revenue Code.

Homeowners who install geothermal can get the tax credit simply by filling out a form declaring the amount you. Federal Geothermal Tax Credits have recently been amended thus you may have 26 Federal Geothermal Tax Credits to get for systems installed by Jan. A home is where you lived in 2021 and can include a house houseboat mobile home cooperative apartment condominium and a manufactured home that conforms to.

102-486 the only tax credits remaining from the Energy Tax Act of 1978 PL. Nebraska Solar and Renewable Energy Incentives. Electricity from wind closed-loop biomass and geothermal resources receive as much as 25 centskWh.

The taxpayer spends 12000 to install a new geothermal heat pump property in 2021. DEPRECIATION OF ENERGY PROPERTY. The tax credit currently stands at 26 percent throughout 2021 and 2022 before decreasing to 22 percent in 2023.

However after 2019 the credit value will be steadily reduced so its worth installing these energy-efficient upgrades now. Department of General Services - Procurement Division. Department of General Services.

What is the Geothermal Tax Credit. E-File Your Tax Return Online. Because they use the earths natural heat they are among the most efficient and comfortable heating and cooling technologies.

You may be able to take a credit of 26 of your costs of qualified solar electric property solar water heating property small wind energy property. California Code of Regulations. Sunny Nebraska is a great state for solar power and renewable energy.

The PTC provides a corporate tax credit of 13 centskWh for electricity generated from landfill gas LFG open-loop biomass municipal solid waste resources qualified hydroelectric and marine and hydrokinetic 150 kW or larger. View Residential Tax Incentive Guide Energy Star Compliance Certificate. Geothermal heat pumps are similar to ordinary heat pumps but use the ground instead of outside air to provide heating air conditioning and in most cases hot water.

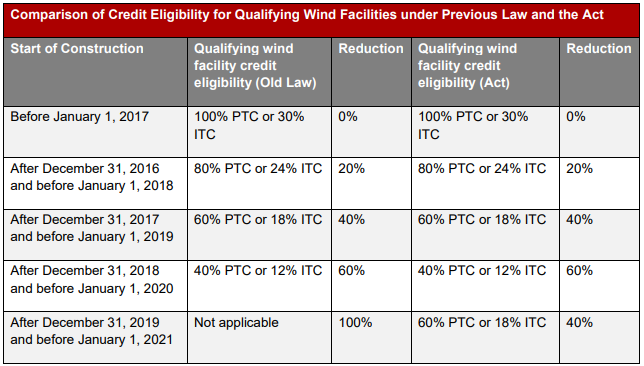

Renewable energy tax credits for fuel cells small wind turbines and geothermal heat pumps now feature a gradual step down in the credit value the same as those for solar energy systems. The tax credits for solar and geothermal as did the Tax Extension Act of 1991 PL. Combine the falling cost of solar equipment and installation state tax credits and rebates and the 30 Federal tax rebate and.

95-618 were the newly permanent 10 solar and geothermal credits. A 26 federal tax credit for residential ground source heat pump installations has been extended through December 31 2022. All tax credits on these products are eligible until December 31 st 2021.

Small Business Assistance Center. Through this legislation geothermal heat pumps were added to the definition of energy property under section 48a of the Internal Revenue Code which provides a 10 investment tax credit for spending on property the construction of which begins prior to 112022. Who Can Take the Credits You may be able to take the credits if you made energy saving improvements to your home located in the United States in 2021.

Solar And Wind Tax Credits Extended Again Perspectives Events Mayer Brown

What Is The 2021 Geothermal Tax Credit Climatemaster Geothermal Hvac

Irs Form 5695 Lines 1 4 Irs Forms Irs Tax Credits

Irs Releases 2021 Section 45 Production Tax Credit Amounts Mayer Brown Tax Equity Times Jdsupra

The Federal Geothermal Tax Credit Your Questions Answered

What Federal Tax Incentives Are There For Geothermal Heat Pumps

Solar And Wind Tax Credits Extended Again Perspectives Events Mayer Brown

300 Federal Tax Credits For Air Conditioners And Heat Pumps Symbiont Air Conditioning

New Law Extends Tax Credits For Wind And Other Renewable Power Plants Lexology